where's my unemployment tax refund check

View Refund Demand Status. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Check For the Latest Updates and Resources Throughout The Tax Season.

. The IRS should issue your refund check within six to eight weeks of filing a paper return. If you chose to receive your refund through direct deposit you should receive it within a week. Check your unemployment refund status by.

Ad Get Reliable Answers to Tax Questions Online. See How Long It Could Take Your 2021 Tax Refund. If you use e-file your refund should be issued between two and three weeks.

Ad Learn About the Common Reasons for a Tax Refund Delay and What To Do Next. In Box 11 you will see the amount of state income tax that was withheld. Everything is included Premium features IRS e-file 1099-G and more.

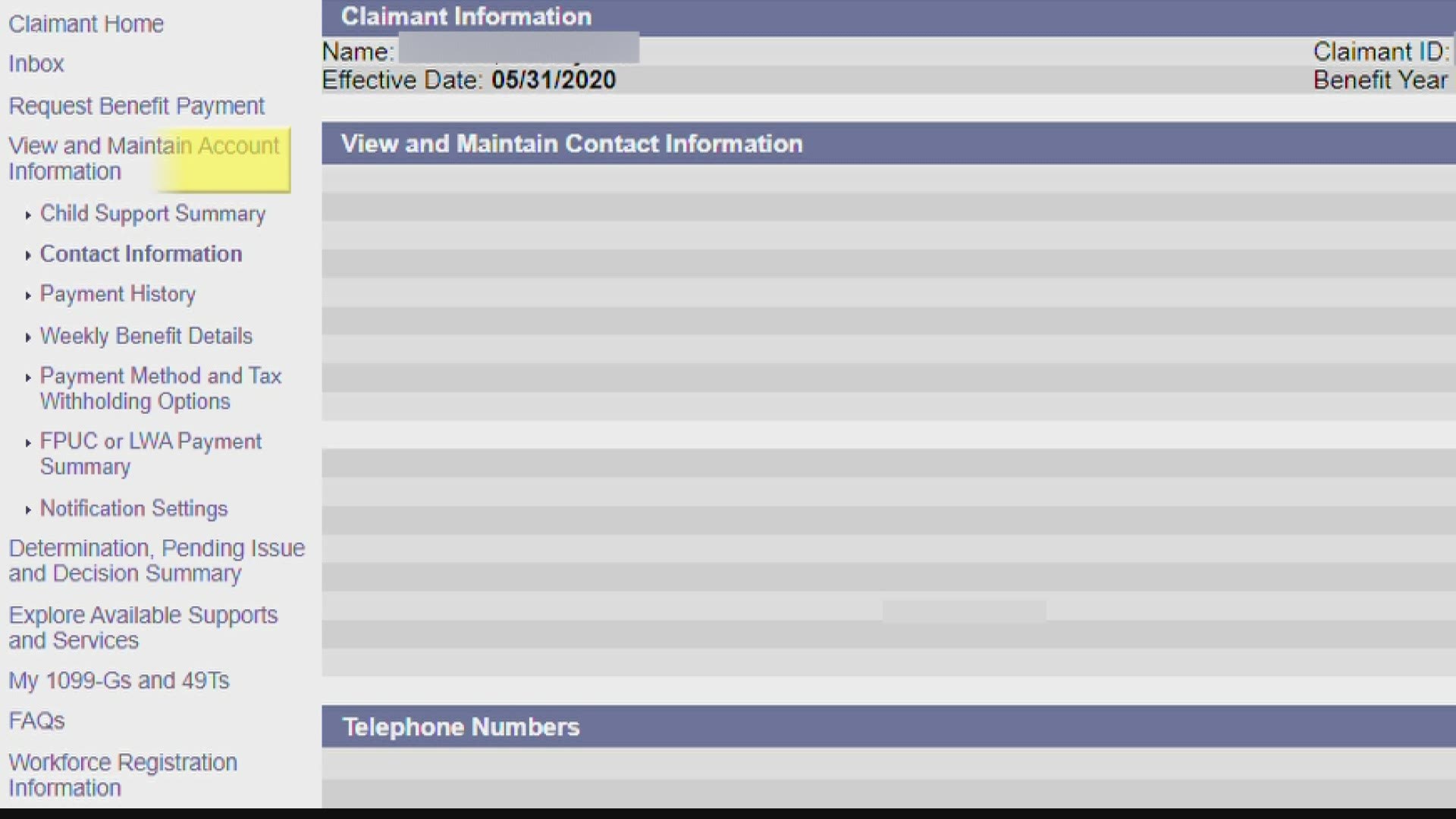

Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. If you use Account Services select My Return Status once you have logged in. Since may the irs has.

Unemployment tax refund status. Since May the IRS has issued over 87 million unemployment compensation refunds. When you create a MILogin account you are.

Participants complete Individual Income Tax Return 1040 Forms using the fraudulently obtained information falsifying wages earned taxes withheld and other data and always ensuring the fraudulent form generates a tax refund check from the US. Visit Wait times to review normal refund and return processing timeframes. ANCHOR payments will be paid in the form of a direct deposit or check not as credits to property tax bills.

An immediate way to see if the IRS. As an employer the City also pays a tax equal to the amount. Below details would be displayed.

Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long. The IRS has sent 87 million unemployment compensation refunds so far. Check My Refund Status.

Using the IRS Wheres My Refund tool. Account Services or Guest Services. Filed your 2020 tax return and.

On Form 1099-G. You dont need to attach Form. Check the status of your refund through an online tax account.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment tax. In Box 4 you will see the amount of federal income tax that was withheld. Using the IRSs Wheres My Refund feature.

Making a phone call to the Internal Revenue Service IRS at 1-800-829-1040 You may have to wait a. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. In Box 1 you will see the total amount of unemployment benefits you received.

Viewing your IRS account information. There are two options to access your account information. You donât need to do anything.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. Your tax return will be processed with the updated requirements. Viewing the details of your IRS account.

We will begin paying ANCHOR benefits in the late Spring of 2023. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. The deadline for filing your ANCHOR benefit application is December 30 2022.

Go to My Account and click on RefundDemand Status. Certified Public Accountants are Ready Now. Online Account allows you to securely access more information about your individual account.

The 10200 is the amount of income exclusion for single filers not the amount of the refund. This is the fourth round of refunds related to the unemployment compensation exclusion provision. You may check the status of your refund using self-service.

Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing. My unemployment actually went to my turbo card. Federal law requires employers to withhold taxes from an employees earnings to fund the Social Security and Medicare programs.

Will display the status of your refund usually on the most recent tax year refund we have on file for you. Ad Learn How Long It Could Take Your 2021 Tax Refund. You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but.

These are called Federal Insurance Contributions Act FICA taxes. Whether you owe taxes or are awaiting a refund you may check the status of your tax return by. You can check on the status.

The Internal Revenue Service doesnt have a separate portal for checking the unemployment compensation tax refunds.

Ca Unemployment 300 Boost Ui Peuc Pua Fed Ed Explained Abc10 Com

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

/cloudfront-us-east-1.images.arcpublishing.com/gray/VRITH76DFJE25JE3MALOAJELP4.jpg)

Asked And Answered Filing Taxes While On Unemployment

/Balance_Tax_Refund_Status_Online_1290006-9f809670a73041a7a6caa96dd5592c99.jpg)

Trace Your Tax Refund Status Online With Irs Gov

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

10 200 Unemployment Tax Break Refund How To Know If I Will Get It As Usa

Irs Unemployment Refund Status Has My Payment Been Held

/cloudfront-us-east-1.images.arcpublishing.com/gray/UEKA5DRH4VEE7DDH7MZ67VRQIY.jpg)

Irs Backlogs Causing Massive Delays In Processing Returns

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Irs Automatic Refunds Coming For 10 200 Unemployment Tax Break

Irs Unemployment Refund Update How To Track And Check Its State As Usa

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

I Got Unemployment In Florida How Will My Taxes Be Affected Firstcoastnews Com

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

I Got Unemployment In Florida How Will My Taxes Be Affected Firstcoastnews Com

Where S My Refund Track My Income Tax Refund Status H R Block